- Accelerator/Decelerator Oscillator

- Accumulation/Distribution

- Alligator

- Average Directional Movement Index

- Average True Range

- Awesome Oscillator

- Bears Power

- Bollinger Bands

- Bulls Power

- Commodity Channel Index

- DeMarker

- Envelopes

- Force Index

- Fractals

- Gator Oscillator

- Ichimoku Kinko Hyo

- Market Facilitation Index

- Momentum

- Money Flow Index

- Moving Average

- Moving Average Convergence/Divergence

- Moving Average of Oscillator

- On Balance Volume

- Parabolic SAR

- Relative Strength Index

- Relative Vigor Index

- Standard Deviation

- Stochastic Oscillator

- Williams' Percent Range

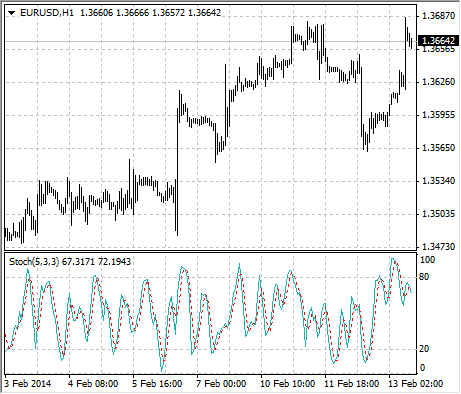

Stochastic Oscillator

The Stochastic Oscillator Technical Indicator compares where a securitys price closed relative to its price range over a given time period. The Stochastic Oscillator is displayed as two lines. The main line is called %K. The second line, called %D, is a Moving Average of %K. The %K line is usually displayed as a solid line and the %D line is usually displayed as a dotted line.

There are several ways to interpret a Stochastic Oscillator. Three popular methods include:

- Buy when the Oscillator (either %K or %D) falls below a specific level (for example, 20) and then rises above that level. Sell when the Oscillator rises above a specific level (for example, 80) and then falls below that level;

- Buy when the %K line rises above the %D line and sell when the %K line falls below the %D line;

- Look for divergences. For instance: where prices are making a series of new highs and the Stochastic Oscillator is failing to surpass its previous highs.

Calculation

The Stochastic Oscillator has four variables:

- %K periods. This is the number of time periods used in the stochastic calculation;

- %K Slowing Periods. This value controls the internal smoothing of %K. A value of 1 is considered a fast stochastic; a value of 3 is considered a slow stochastic;

- %D periods. his is the number of time periods used when calculating a moving average of %K;

- %D method. The method (i.e., Exponential, Simple, Smoothed, or Weighted) that is used to calculate %D.

The formula for %K is: %K = (CLOSE-LOW(%K))/(HIGH(%K)-LOW(%K))*100

Where:

CLOSE – is todays closing price;

LOW(%K) – is the lowest low in %K periods;

HIGH(%K) – is the highest high in %K periods.

The %D moving average is calculated according to the formula: %D = SMA(%K, N)

Where:

N – is the smoothing period;

SMA – is the Simple Moving Average.