18 June 2018

Five important MetaTrader 5 build 1860 features for algorithmic traders

MetaQuotes

Why you need to upgrade MetaTrader 5 right now, if you are using MQL5 and create trading robots:

- In response to popular demand from traders, we have added the following functions for operations with timeseries: iTime, iOpen, iHigh, iLow, iClose, iVolume, iBars, iBarShift, iLowest, iHighest, iRealVolume, iTickVolume and iSpread. Now, developers can easily transfer their MetaTrader 4 applications code to the fifth generation platform, since these functions have been migrated from MQL4. Detailed descriptions and function codes are available in the MetaTrader 5 build 1860 announcement.

- MQL5 applications can run faster due to the additional source code optimization during compilation. Recompile your programs with the new MetaEditor version to improve their performance.

- We have completely updated the optimization cache operation in the Strategy Tester. In earlier versions, optimization cache was stored as one XML file. All Expert Advisor optimization passes, with specified testing settings, were recorded to this file. Therefore, the same file stored optimization results with different input parameters. Now, the optimization cache is stored as separate binary files, for each set of optimized parameters. Strategy Tester operations, involving the optimization cache, have become significantly faster due to the new format and smaller file size. This can be significantly noticeable when you resume a paused optimization pass.

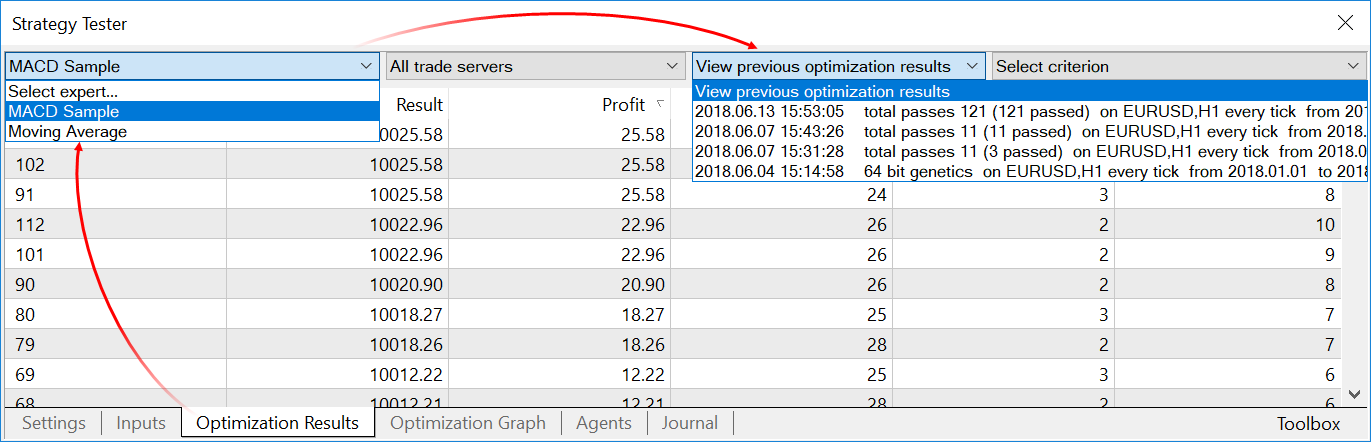

Viewing results of previous optimizations.

The results of previously performed optimizations can be viewed right in the Strategy Tester, so there is no need to analyze large XML files using third-party software. Open the "Optimization results" tab, select an Expert Advisor and a file with the desired optimization cache. The list contains all Expert Advisor optimization cache files available on the disk. Optimization date, testing settings (symbol, timeframe and interval) and input parameters are shown for each file. You can additionally filter optimization results by the trade server.

Recalculation of optimization criteria 'on the fly'

Previously, only one criterion selected before optimization start was calculated during optimization as such. You can now change the optimization criterion 'on the fly' from the results view mode — all values will be automatically recalculated in the Strategy Tester.

The optimization criterion is a certain variable parameter, the value of which determines the quality of a tested set of inputs. The higher the value of the optimization criterion, the better the testing pass is considered to be.

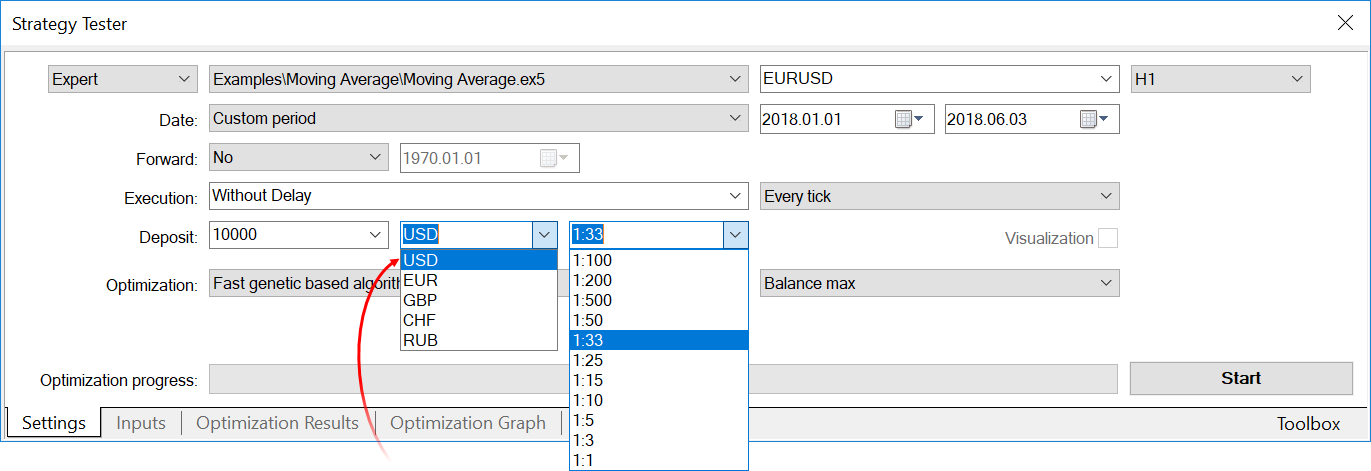

- The new version allows manual setting of the deposit currency and leverage to be used during testing and optimization. In earlier versions, these parameters were set in accordance with the connected account, so they could only be changed by switching to other accounts.

- The use of OpenCL is now allowed in testing agents. Previously, OpenCL devices were only allowed when testing on local agents. In the updated version, agents are allowed to use all available OpenCL devices (such as processors and video cards), both in the local network and in the MQL5 Cloud Network.

See the previous news, please:

- New account opening dialog in MetaTrader 5: useful for traders and regulated brokers

- GT247.com profit climbed by 105% after MetaTrader 5 launch

- JRG International Brokerage DMCC launched MetaTrader 5 for DGCX trading

- Gaining a foothold in Britain: Valutrades switches to MetaTrader 5

- MetaTrader 5 receives updated DMA solutions from oneZero in the Marketplace