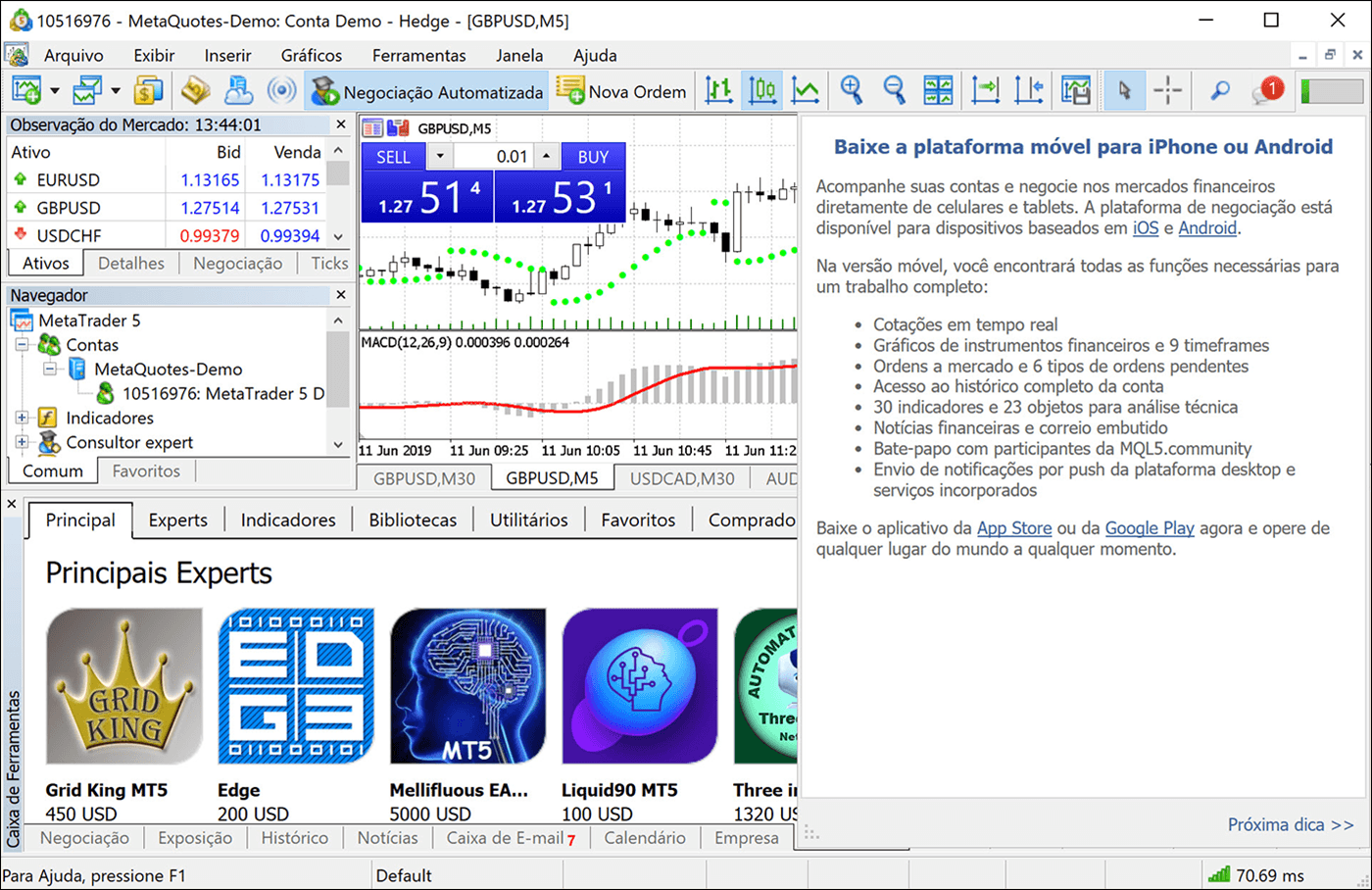

GBE brokers, a CySEC licensed financial services company which also operates the GBE Prime liquidity brand, has started offering the MetaTrader5 platform to their clients.

The GBE CEO, Rifat Sayim, commented: “We are delighted to offer the technically advanced MetaTrader 5 platform to our clients. It will offer traders with much more functionality especially around the integration capability of the platform software and the use of tools."

Mr Rifat Sayim, CEO of GBE brokers

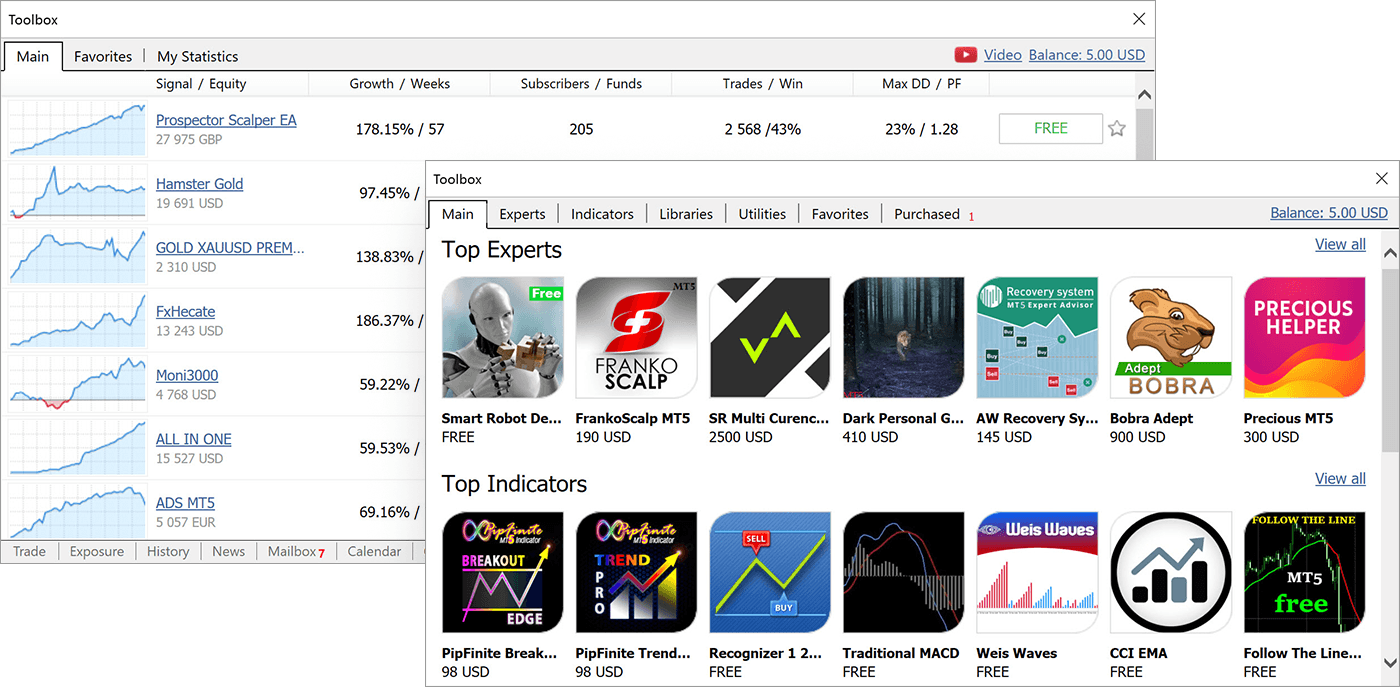

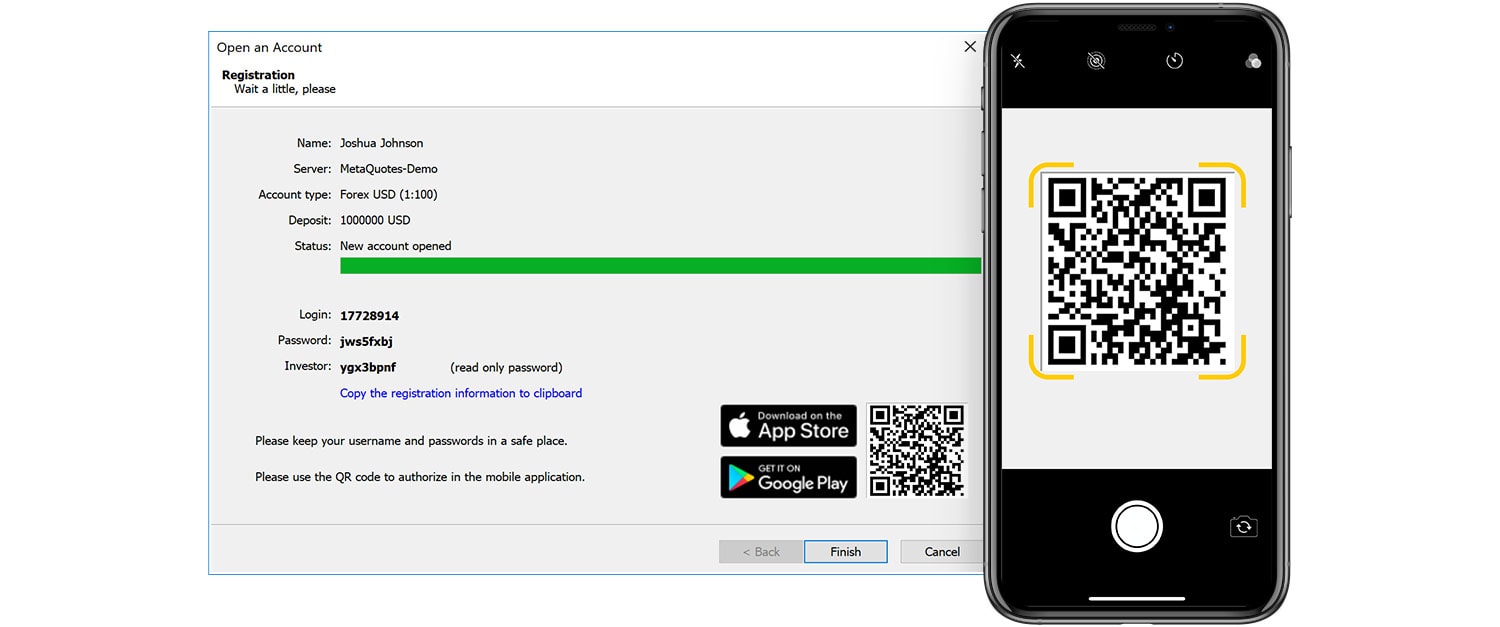

Features of MetaTrader 5 from GBE brokers:

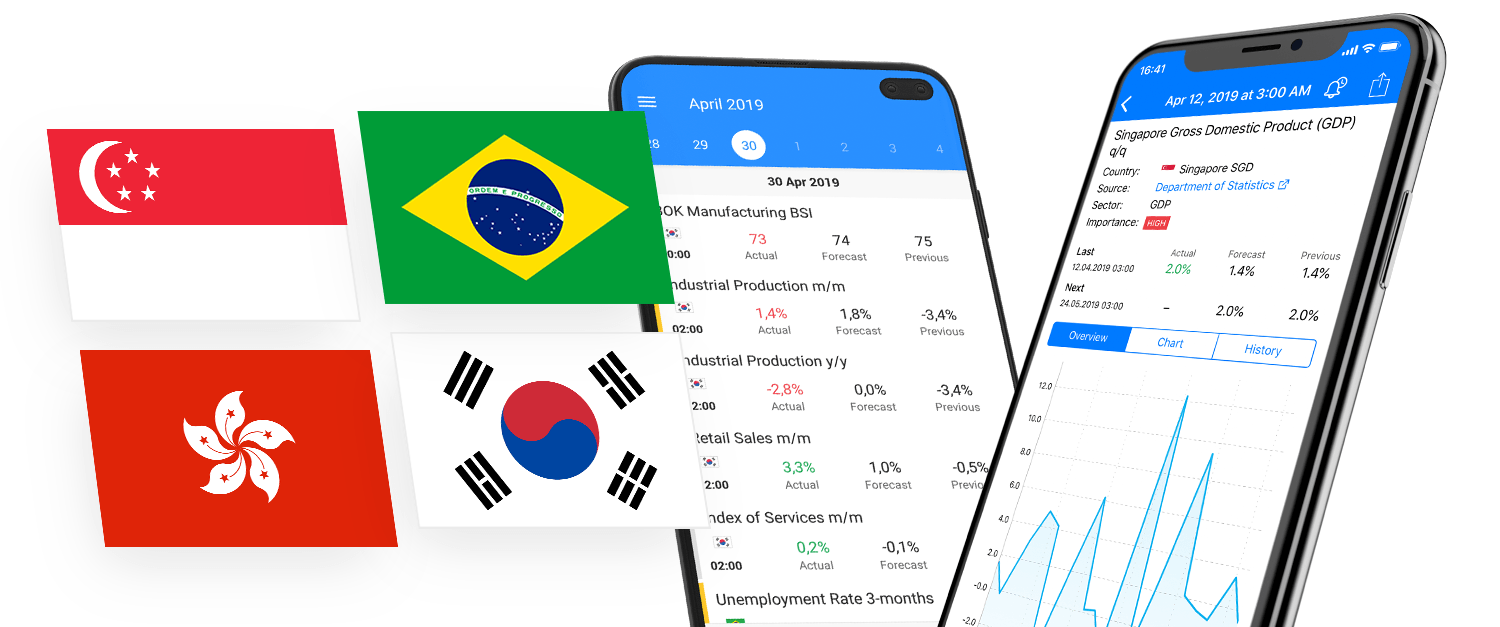

- More than 200 forex, index, stock, commodity and energy instruments

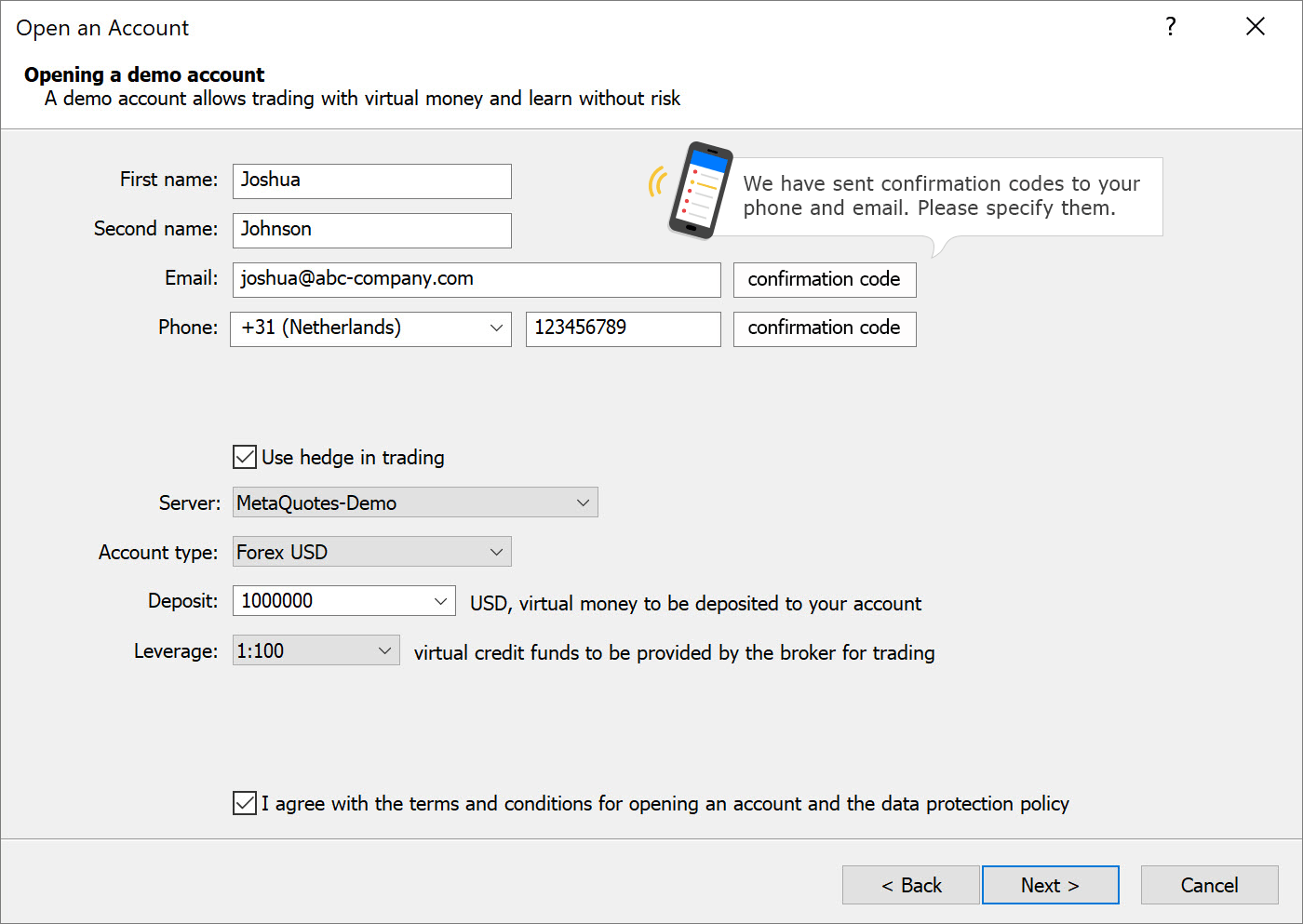

- Hedged trading via parallel long and short positions

- Supported deal volume from 0.01 lot

- Accurate position clearing

- High order execution speed

- STP with direct market access

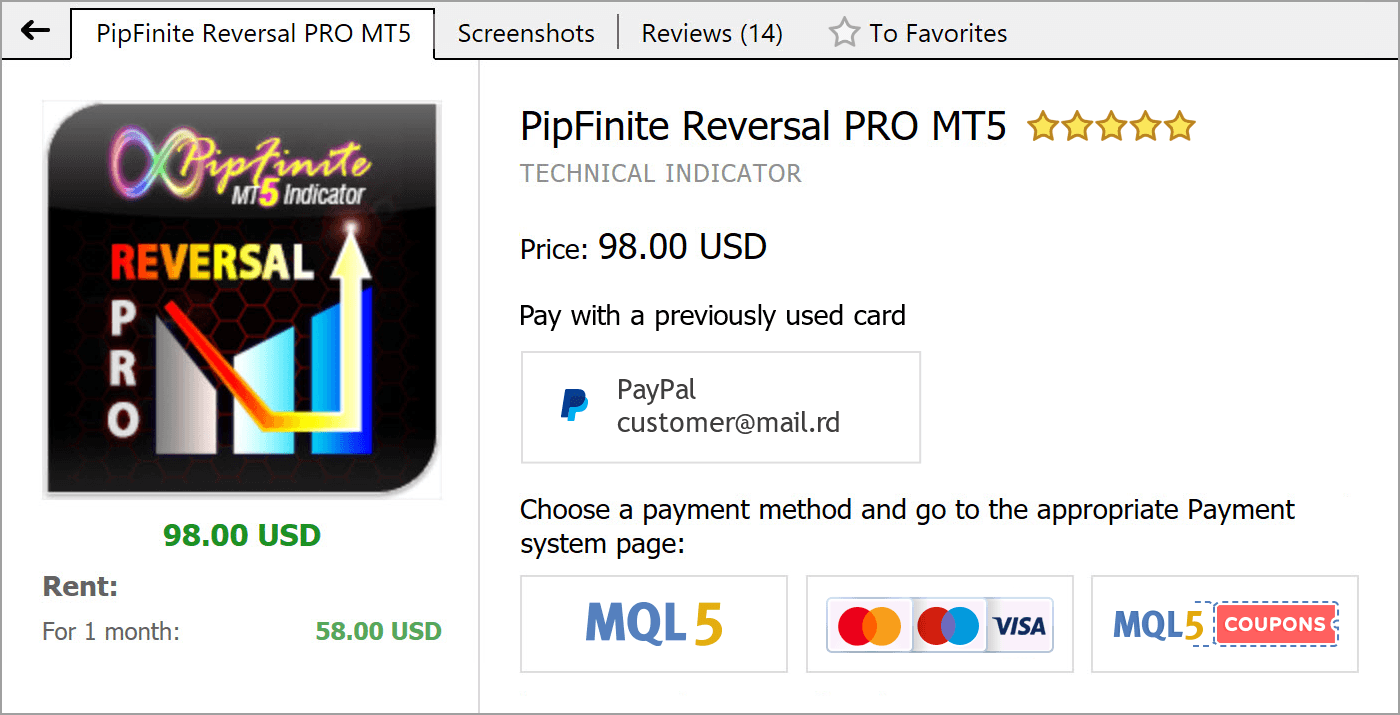

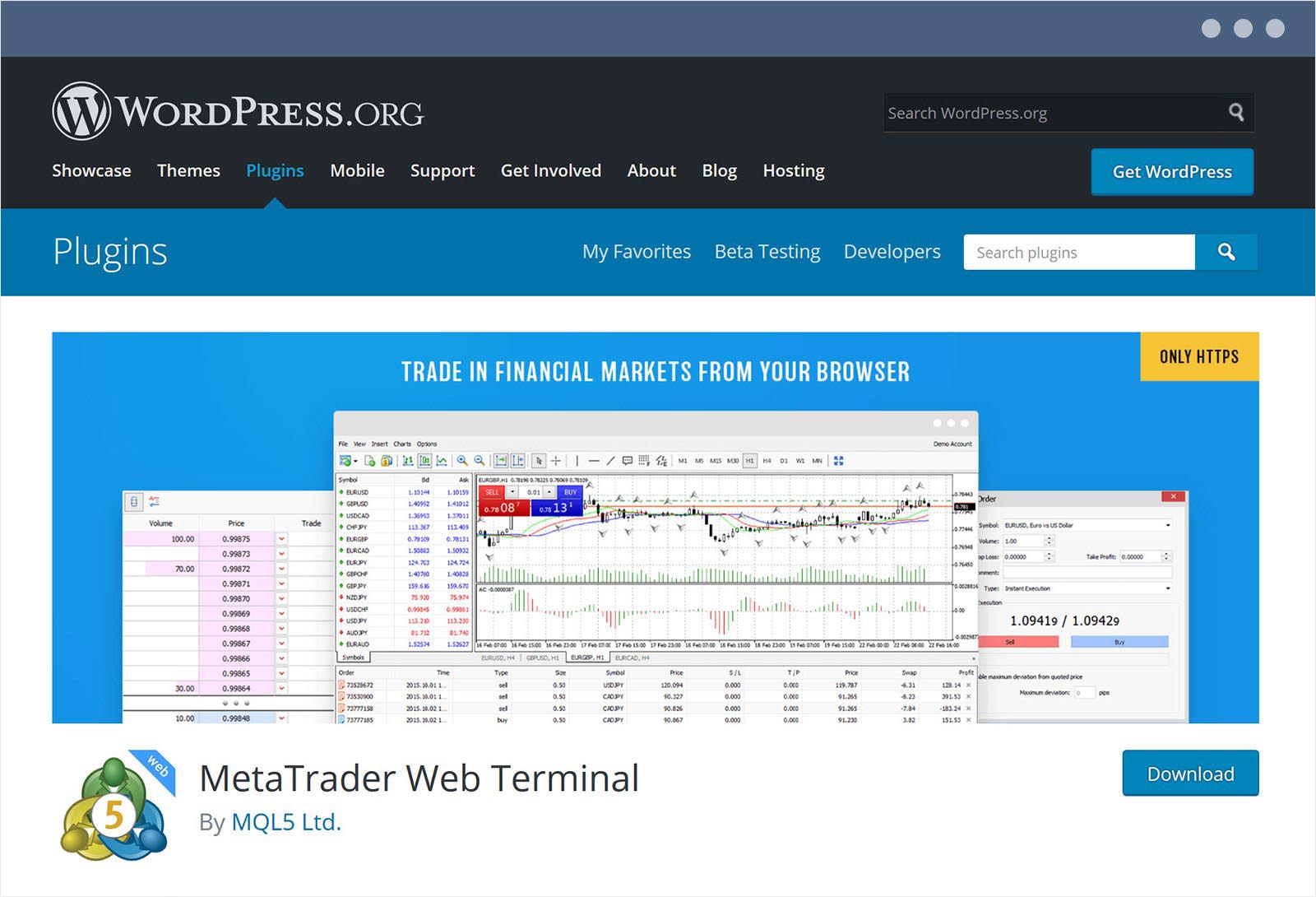

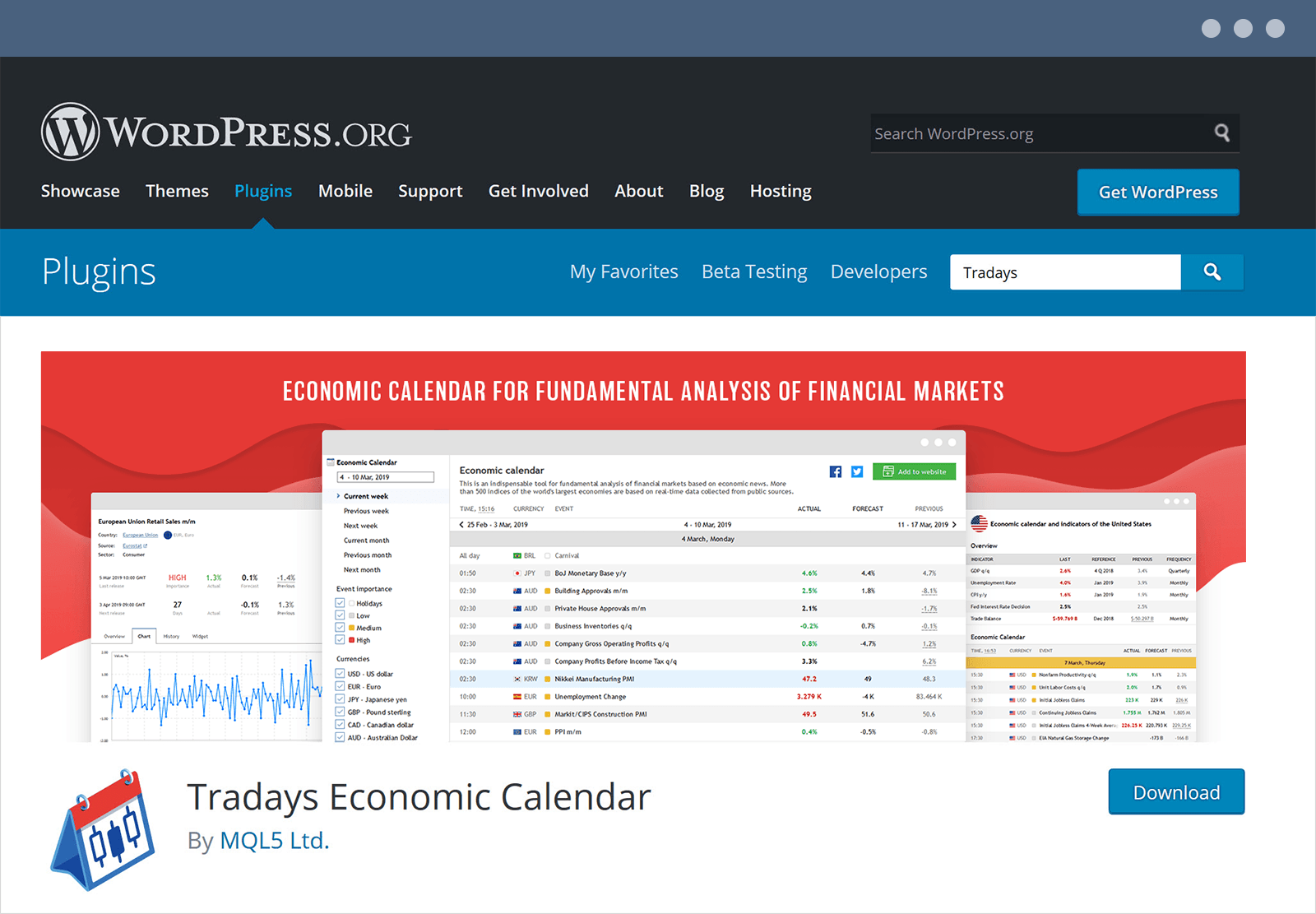

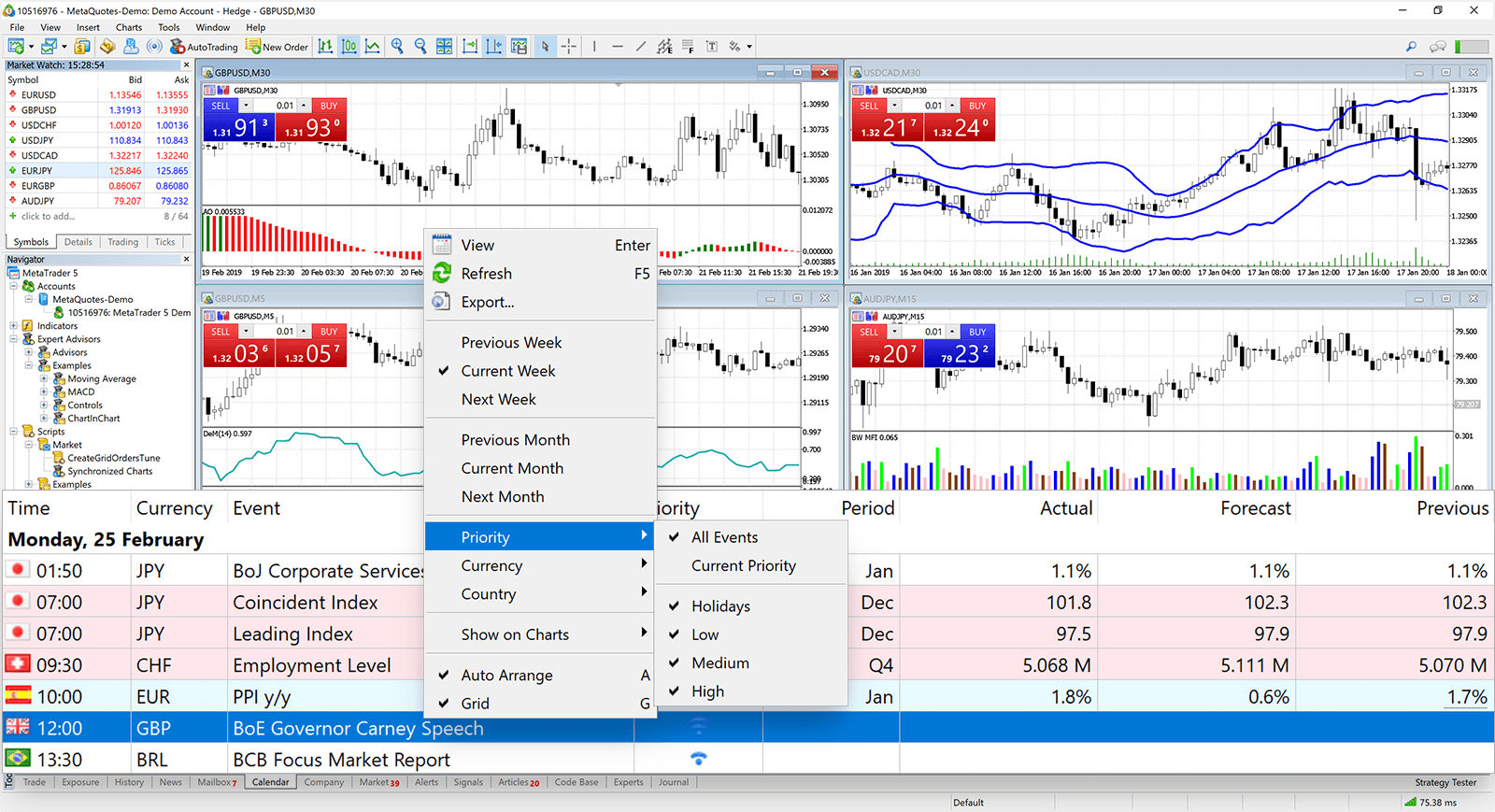

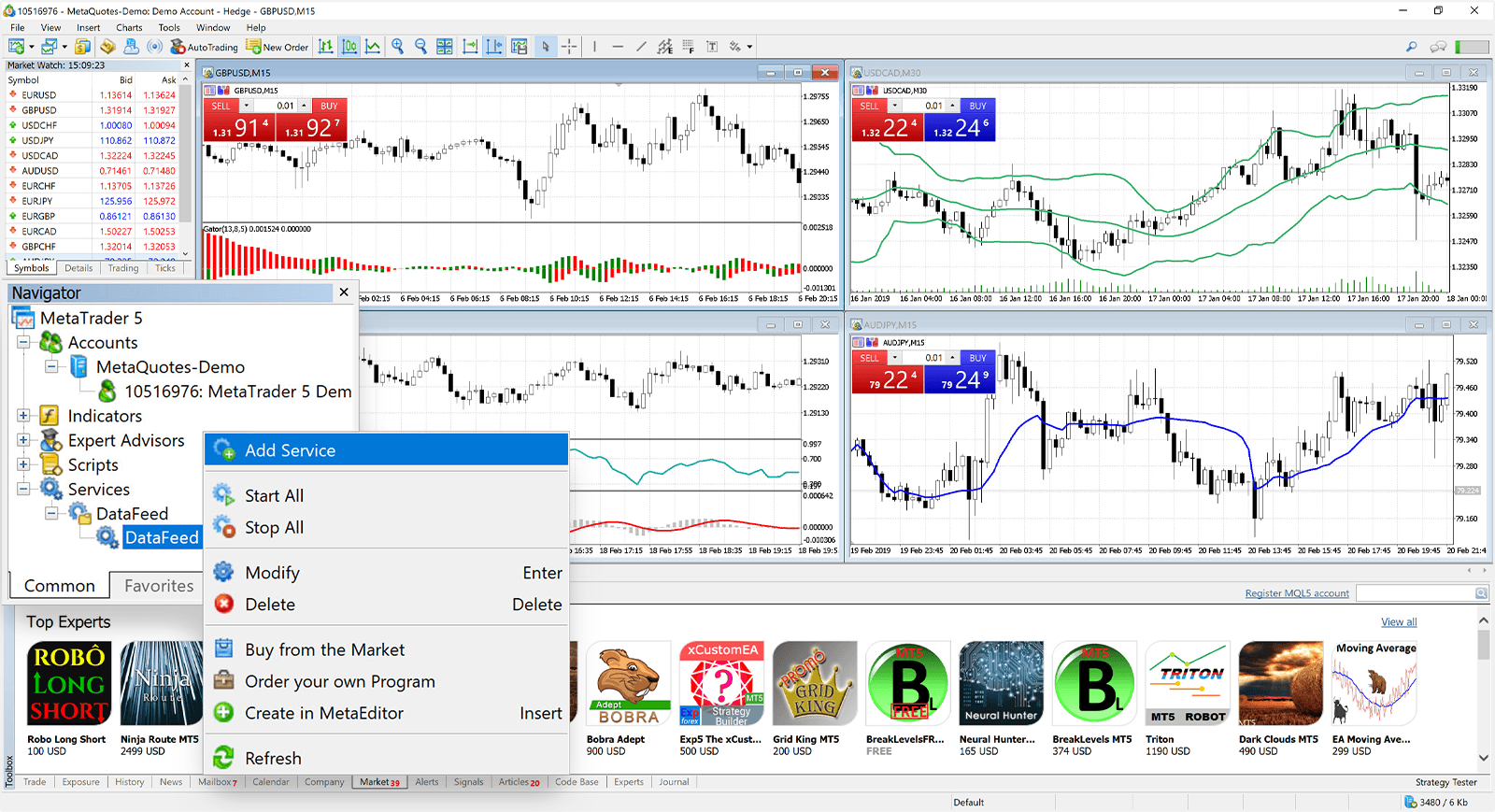

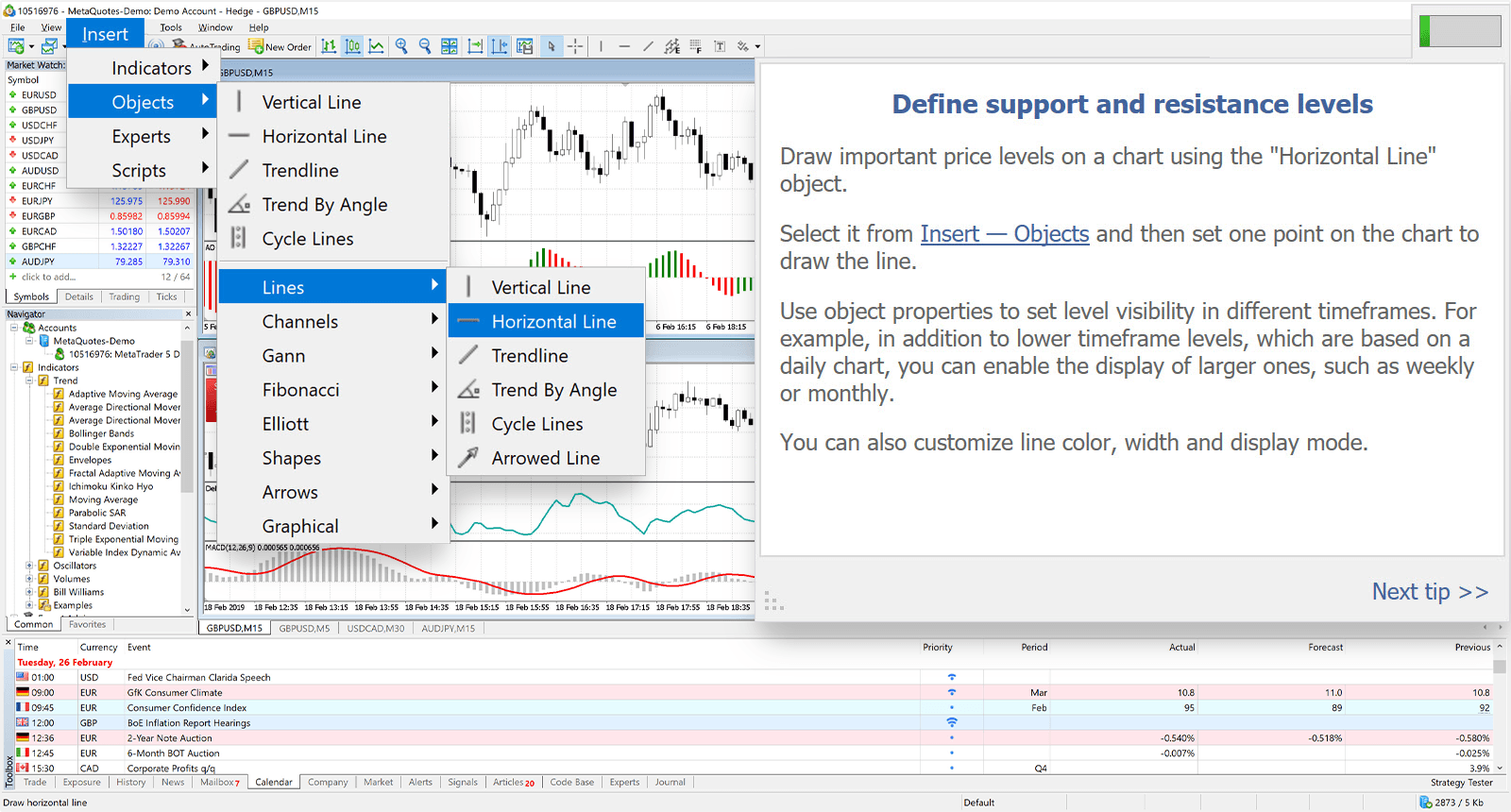

- Professional fundamental and technical analysis tools

- One-click order management

Mr Ben-Florian Henke, Head of GBE Prime

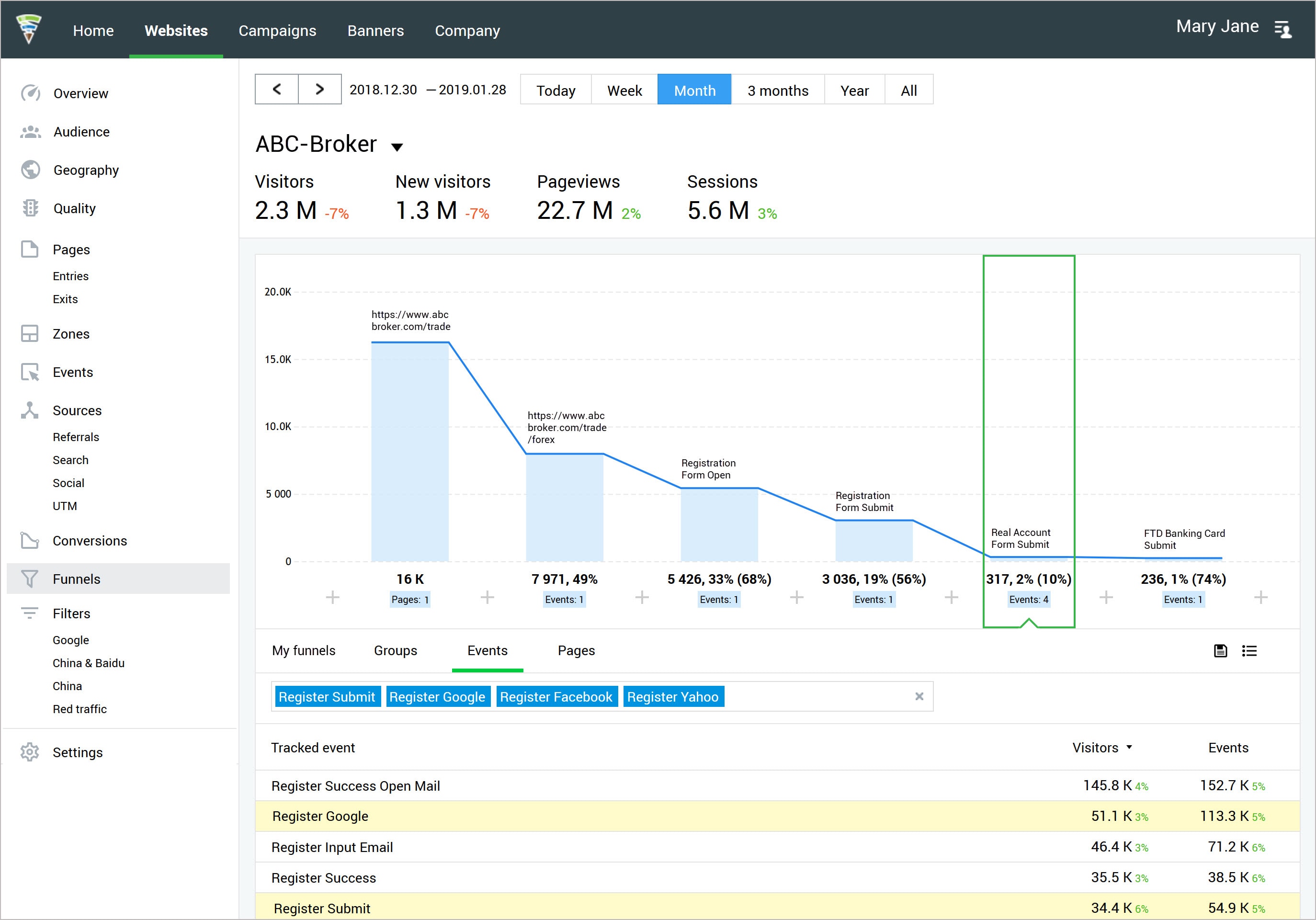

The Head of GBE Prime, Mr Ben-Florian Henke, pointed out that "GBE will now start offering White Label Services for the MetaTrader 5 platform. Our clients will receive access to coverage account functionalities for their API connections via MetaTrader 5."